Netflix's competitors have delivered another telling blow to the world's biggest streamer amid its ongoing subscriber issues.

Yesterday (Tuesday, July 19), Netflix revealed it lost another 970,000 subscribers between Q1 and Q2 2022 – a significant loss that's sure to hit it financially at some point, despite a slight increase in its overall revenue.

However, while Netflix tried to put a positive spin on things – namely, talking about Stranger Things 4's massive success and a launch window for its ad-supported subscription tier – the streaming giant suffered another hit as its Q2 earnings report was taking place. And, this time, Netflix's major competitors are behind its latest gut punch.

According to leading analytics company Parrot Analytics, Netflix's six primary competitors – including Disney Plus, Prime Video, and HBO Max – posted a combined global demand share higher than Netflix for the first time in streaming history.

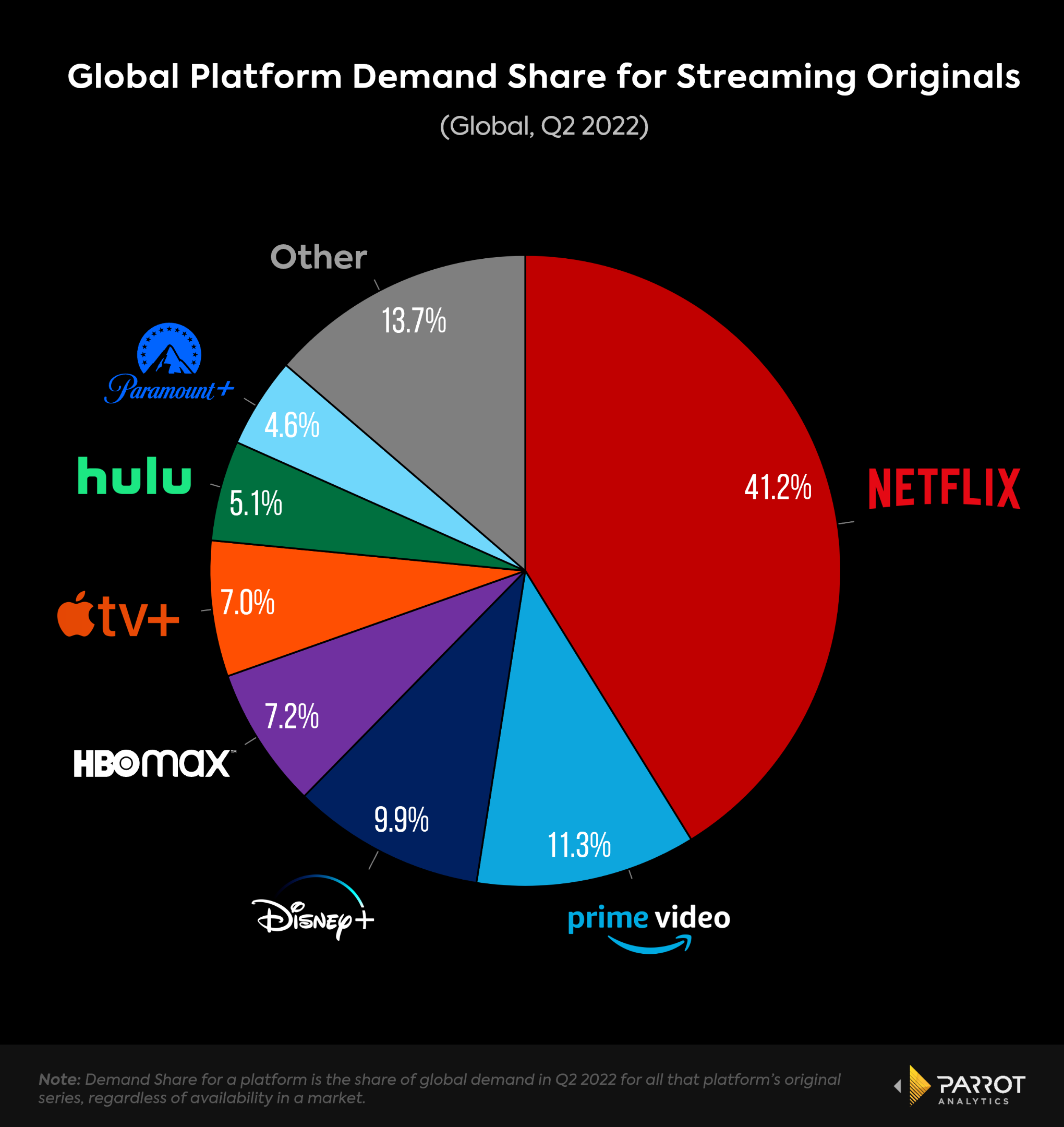

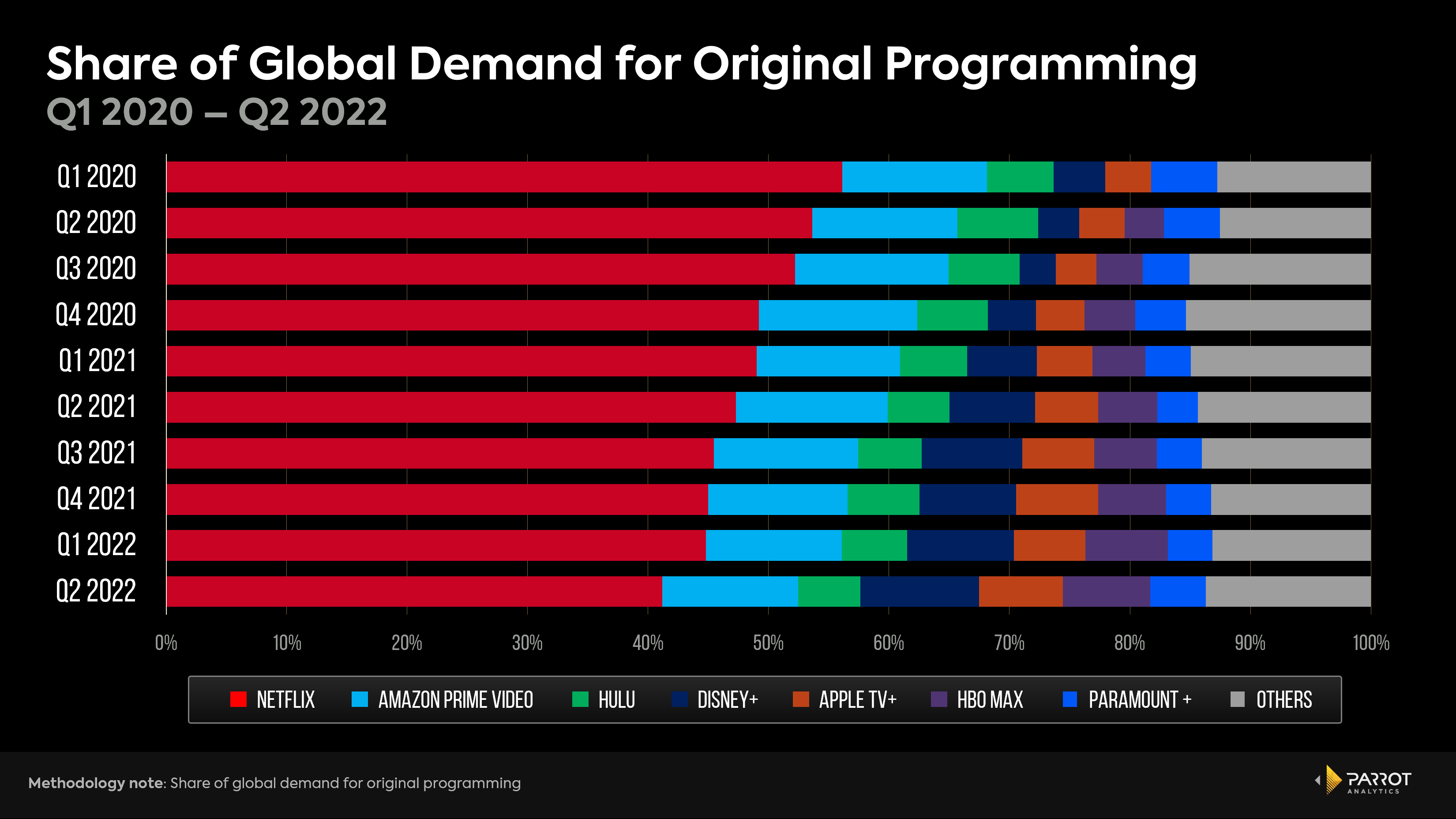

Alongside Hulu, Paramount Plus, and Apple TV Plus, Netflix's largest streaming competitors held a shared 45.1% of global audience demand for streaming originals. In contrast, Netflix could only muster 41.2% – a sizable drop of almost 14% (from 55%) since Q2 2020.

As the above graph shows, Netflix is still far and away the most popular streaming platform around. With its 11.3% slice of global demand share, Prime Video is a distant second in the grand scheme of things, with Disney Plus, HBO Max, and the rest even further back.

Still, the combined global share of Netflix's competitors is a significant moment in the history of streaming.

Bar Netflix and Prime Video, every other streamer grew its own slice of global demand for their original content. Disney Plus' share grew from 8.8% to 9.9%, Paramount Plus from 3.8% to 4.6% (a personal best for the new kid on the block), Apple TV Plus from 6% to 7%, and HBO Max from 6.7% to 7.2%. Netflix was the only one of the big six to post a fall in its slice of global audience demand for streaming originals.

Clearly, then, Netflix's rivals are slowly making inroads on its dominance of the streaming landscape – but why?

According to Parrot Analytics, the answer is simple: Netflix's competitors are releasing more and better original content than ever before.

Again, as the bar graph above shows, Netflix holds dominion over its streaming rivals when it comes to audience demand for original programming. That'll be down to the likes of Stranger Things season 4, which is the streamer's biggest English language show of all-time – some 1.3 billion hours have been watched by viewers worldwide since season 4 part 1 was released in May. Only Squid Game, which amassed 1.56 billion hours watched upon its initial release in September 2021, has performed better in Netflix's entire history. Well, where its original programming is concerned, anyway.

But Netflix can't afford to pin its hopes on that duo to retain its 220 million strong subscriber base. Yes, new installments in both properties – Stranger Things 5 and Squid Game season 2 – are on the way, which will surely dominate the TV landscape whenever they're released.

Netflix, though, needs other big hitters if it's to hold off its competitors. One of its most popular shows in Ozark ended earlier this year, while another in Better Call Saul is currently on its victory lap. Other success stories, including The Umbrella Academy, Arcane, and Cobra Kai have sizeable viewerships, but none of them can compete with the above quartet.

Meanwhile, Prime Video can boast huge hits like The Boys and Invincible. Disney Plus has a multitude of Star Wars offerings and Marvel content; the latter of which will only continue to grow as more Marvel Phase 4 projects land on the platform. Even HBO Max, Hulu, and Paramount Plus have fan favorite shows at this point.

Meanwhile, Apple TV Plus beat Netflix to one of the latter's most coveted awards – the prize for Best Picture at an Oscars ceremony – when CODA secured the gong at the 2022 Academy Awards. That's sure to have put Apple's streamer on the map and would've been difficult for Netflix executives to watch.

Netflix, then, really needs to up its game in the original movies and shows department. There are potential success stories on the way – The Gray Man, a new movie series starring Ryan Gosling and Chris Evans, could give Netflix a truly great film franchise to make for years to come. But, for every film or TV production that Netflix's subscriber base wants to see, there's a slew of reality TV offerings, less than captivating rom-com genre fare, and the cancelation of fan favorite shows that are likely turning viewers off.

A switch-up in Netflix's original programming blueprint, coupled with other necessary change could see it hold off the advances of Disney Plus and company. Tien Tzuo, CEO and founder of enterprise software company Zuora, believes Netflix needs to adapt, though, if it's to do so.

"The death of Netflix was grossly exaggerated -- there is no 'Great Unsubscribed', Tzuo said via a press release. "Data continues to show that churn or cancellations for subscription businesses is actually lower today than before the pandemic.

"What’s going on is, after being the lone player in the streaming field, Netflix finally now has competition. They are still the king of streaming but, to continue to lead, they can’t just focus on subscriber acquisition – they have to focus on keeping their current subscribers coming back.

"Beyond more shows, Netflix should rethink the binge, offer annual plans, and unbundle their content to create smaller, cheaper (and ad-free) offerings. But whatever happens, we the consumers are the winners."

True, streaming fans have never had it better – as Zhou claims, we are the winners in all this. Netflix, though, also wants to keep winning – and, based on the ominous warning delivered by its rivals, it's got a big fight on its hands to retain its crown.

For more Netflix-based content, check out our best Netflix shows and top-rated Netflix movies lists.

No comments:

Post a Comment