Countingup, the U.K. fintech that provides a business bank account that combines bookkeeping, has raised £2.3 million in seed funding. Leading the round is Forward Partners, with participation from previous backer Frontline Ventures, and JamJar Investments.

Founded last year by Tim Fouracre, who previously founded cloud accounting software Clear Books, Countingup wants to simplify the life of sole traders and other small businesses by reinventing the business current account. Fouracre’s vision is that for small enterprises, business banking and accounting software should be merged so that bookkeeping and filing accounts can be a lot more automated.

“If you are running a business then bookkeeping is a chore, wastes your time and is boring,” the Countingup up founder told me last year. “Your bank surprises you with hidden fees and you’ve probably lost faith in their customer service. Countingup is making starting and running a business really simple… We’re doing that by combining accounting and banking into one simple smartphone app”.

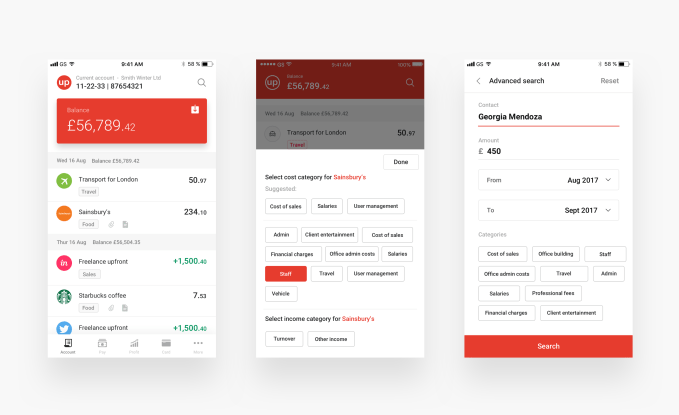

After downloading the Countingup for iOS or Andriod, you are able to open a current account on your smartphone in a claimed 5 minutes. The account comes with a U.K. sort code/account number and a contactless Mastercard. The accounting functionality currently includes a profit and loss report, bookkeeping categorisation and the ability to attach receipts to transactions.

However, the big feature that will be launched later this year is invoicing, while things like “automated receipt scanning,” and tax calculations and filing are also in the 2018 roadmap.

Fouracre says Countingup wants to be the financial platform for 1 million U.K. small businesses. It already has four thousand customers and I’m told is signing up new users at a rate of 1,500 businesses per month.

https://ift.tt/2MMCtnq

No comments:

Post a Comment