Open banking enables bank-to-bank payments, meaning that (in theory) merchants should be able to accept payments without having to hand over fees to Visa or Mastercard or other payment providers, such as Stripe. The challenge, however, isn’t just implementing open-banking based payments as a checkout option — there are are already a host of open banking tech providers — but persuading customers to switch to a new payment option they are likely unfamiliar with.

The solution, according to fintech Trilo, is to offer customers incentives, for using open banking, such as cashback or additional perks, coupled with a user-friendly payment flow. The U.K. startup is breaking cover today with the launch of its alpha.

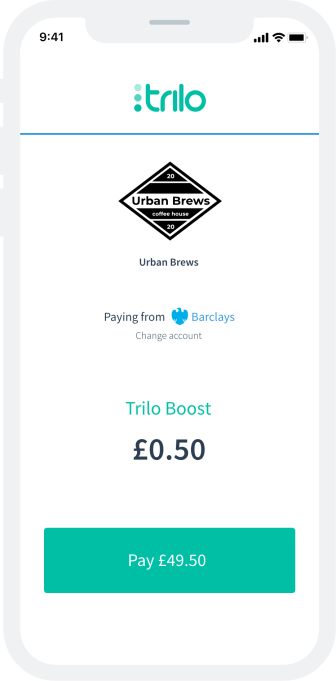

Image Credits: Trilo

Open banking-based payments doesn’t just offer the opportunity to begin to chip away at the Visa/Mastercard duopoly, but should also reduce fraud associated with cards, leading to lower costs for merchants beyond transaction fees alone and less issues for consumers. But that requires take up of the new payment option.

“Open Banking’s great. However, me and you, consumers, have little-to-no-reason to use it,” argues Blythe. “Without an enjoyable, rewarding, and simple user flow, it’s going to be very hard to take off”.

To help remedy this, Trilo is combining an open banking payments API with incentives and rewards for consumers electing to use bank-to-bank payments. The startup is also doing away with transaction fees for merchants and will instead charge a monthly subscription akin to a SaaS model.

“Say goodbye to transaction fees, we’ve scrapped them,” says Blythe. “Our merchant partners also get their money in 5 minutes on average, so they can re-deploy it even faster… [and] consumers get a boost whenever you pay. Our main USP is that we focus on you, making your time as enjoyable, easy and rewarding as possible, whether that’s 1% off, a free beer, or an upgrade, businesses give you a serious reason to stop using your card”.

More broadly, Blythe says open banking gives a startup like Trilo the opportunity to take on “the largest duopoly on earth”.

“But to do this, we need to have the simplest and easiest way to pay out there for me and you,” he says, “while also having some serious kickback available to consumers when they pay. With our network we can also power refunds, consumer protection, and all sorts of other perks that pure open banking simply doesn’t offer”.

To pay with Trilo, you simply scan a QR or tap the Trilo button on a partnering merchant’s website or app. You’ll be remembered on your phone with a cookie, you’ll then see who you’re paying, what bank, and what your boost is, with the amount to pay clearly displayed beneath. “When you tap pay, you’ll hop over to your bank app, and can securely finish off the payment with a tap of the screen,” explains Blythe.

Meanwhile, to kick off Trilo’s alpha and to demonstrate the payments flow, Trilo is partnering with Make It Wild, who are reforesting large areas of the U.K. to help restore the natural eco-system. “With our alpha you’ll be able to fund a tree for a fiver with Trilo, and the best bit, because it’s using Trilo, every single penny will go on the trees,” adds the Trilo founder.

https://ift.tt/34dVcPR

No comments:

Post a Comment